We make taking control of your finances easy.

Make it work for you.

Our comprehensive program is easy to navigate and easy to use. Send bills, make bank deposits, view monthly reports, and more – all from one place. Not sure where to start? Let’s walk you through some of the features you’ll see upon opening the software.

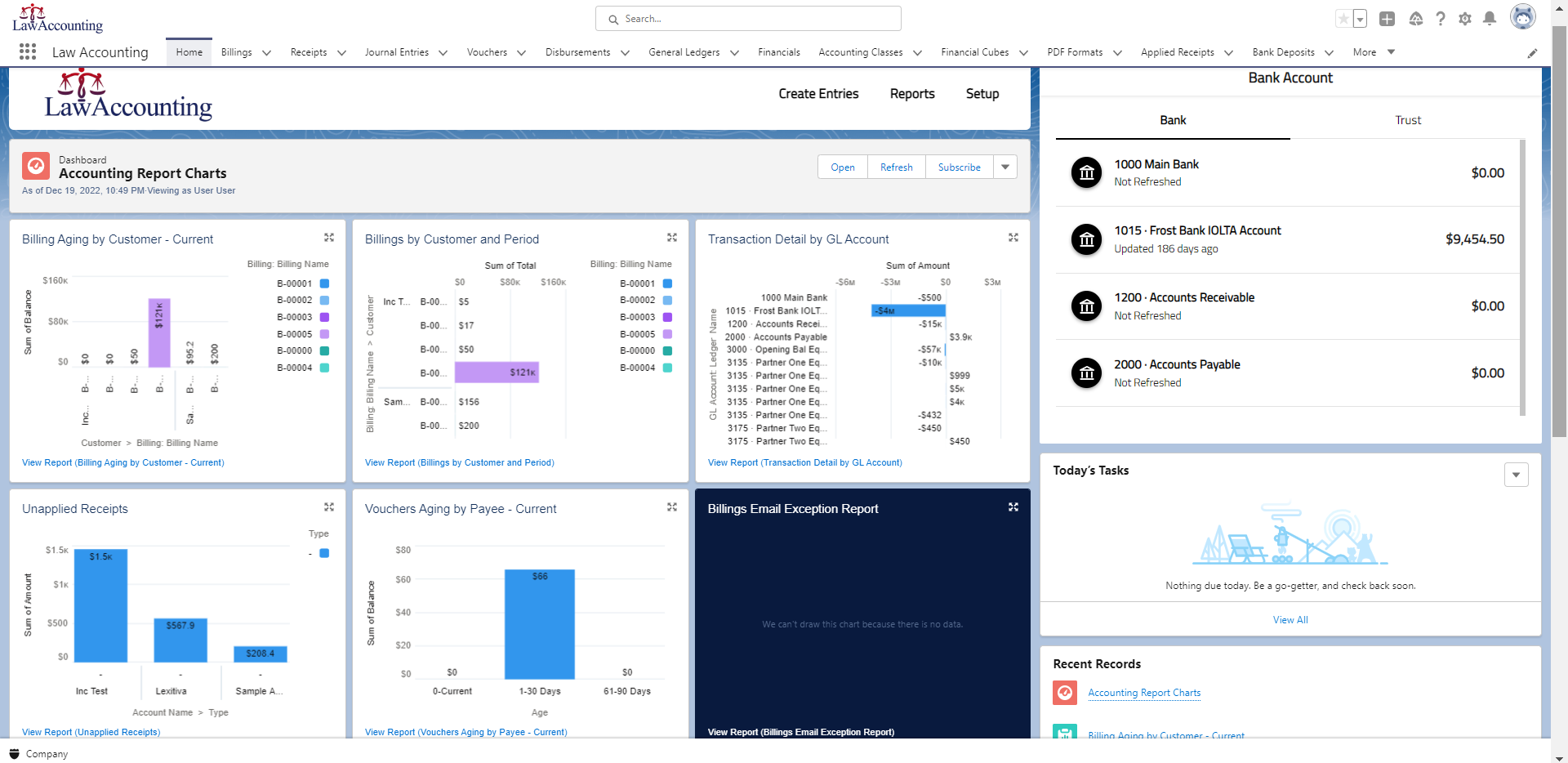

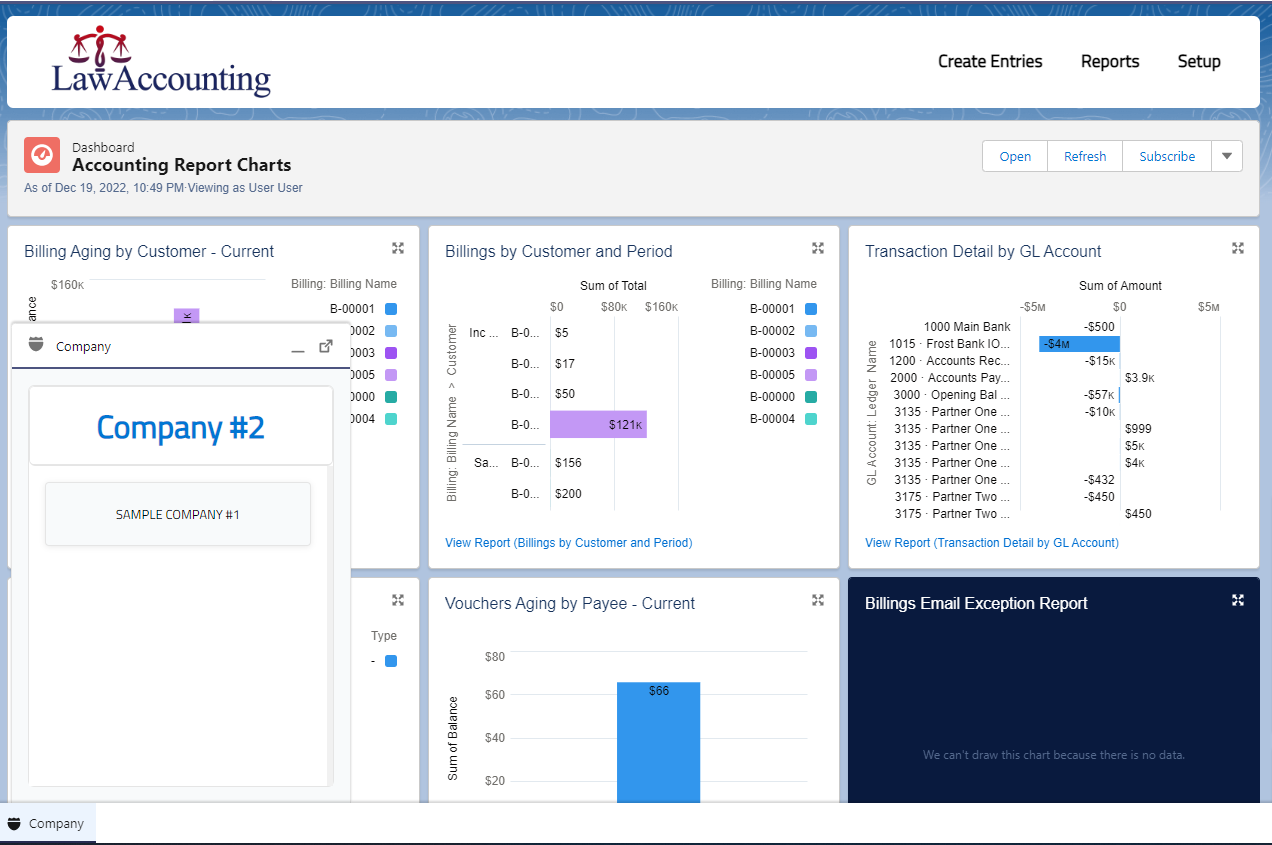

Dashboard

Customizable dashboards that allow you to put the most important features front and center.

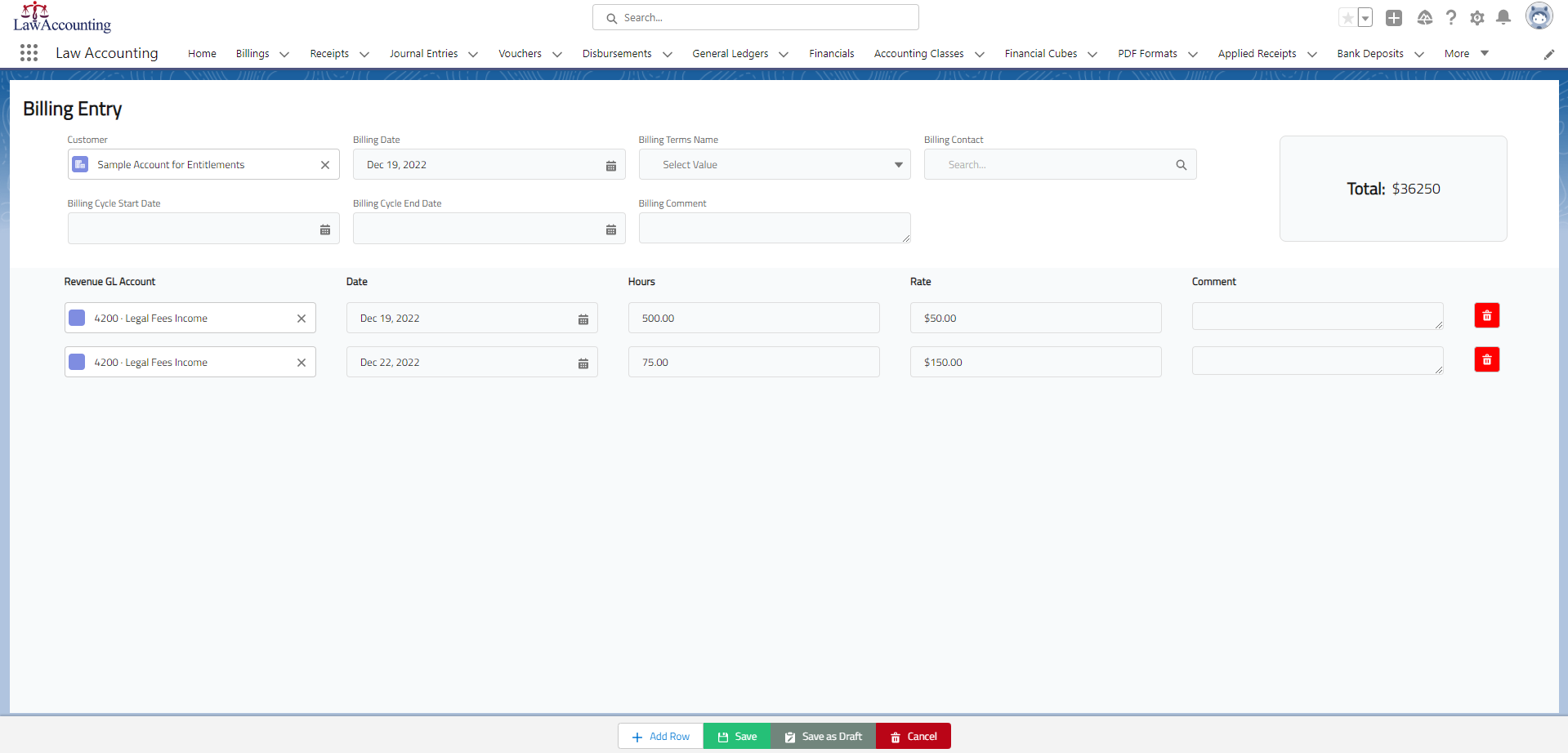

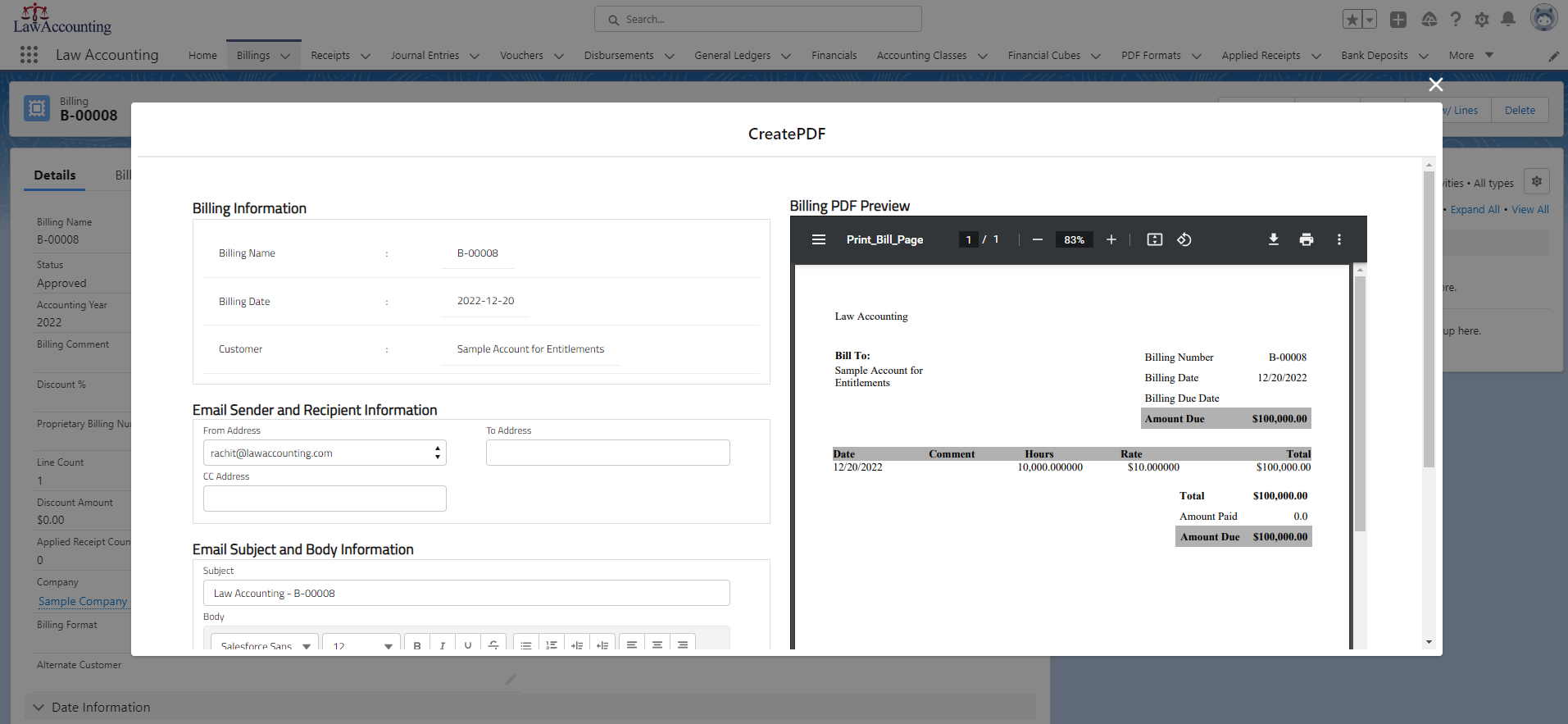

Billing

LawAccounting makes billing easier by automating many of the tasks associated with creating and sending invoices to clients. Some of the features that can make billing easier include:

Customer Payment

Automate many tasks associated with tracking and recording payments from clients.

Vouchers

Create bank vouchers directly through our software, and then store the document on your account.

Financials

Your monthly report brings information together to give you an overview of all of your finances.

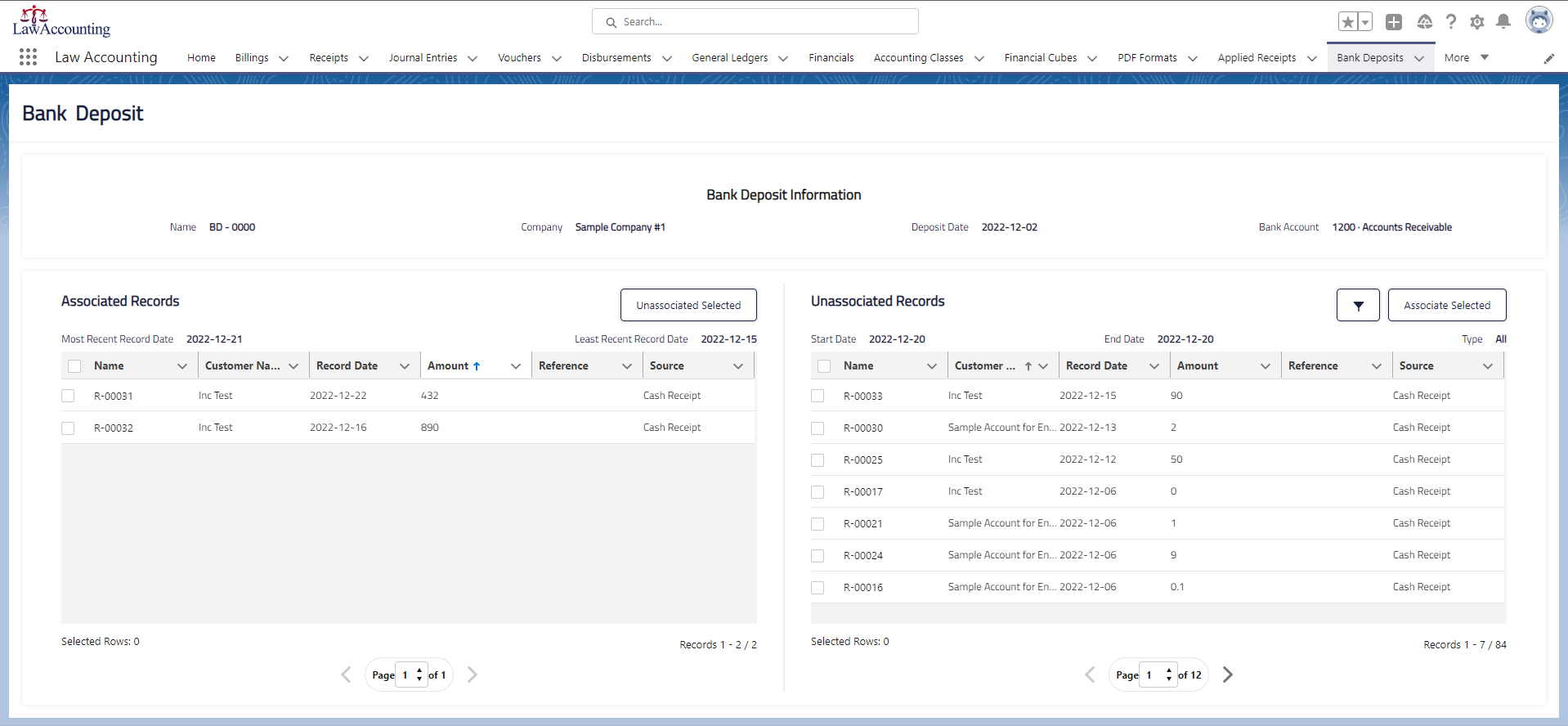

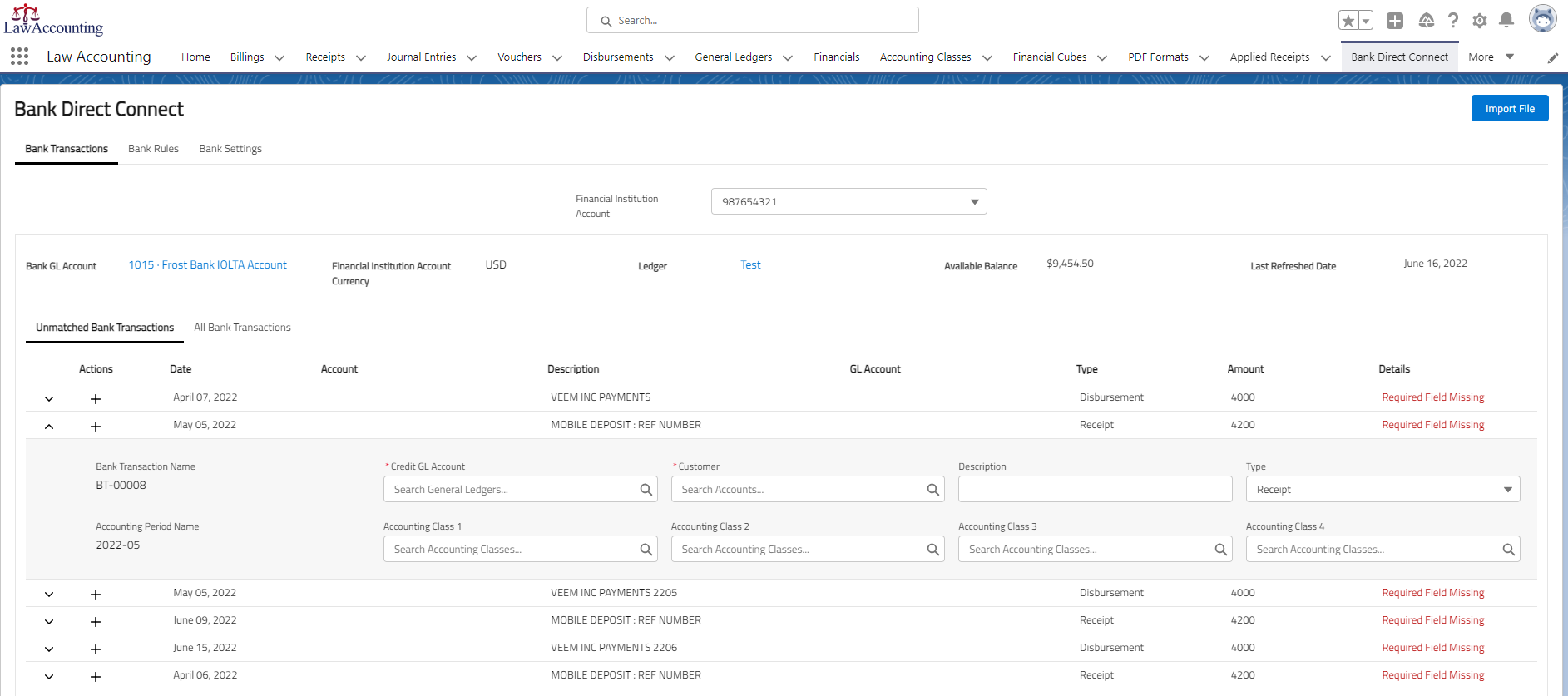

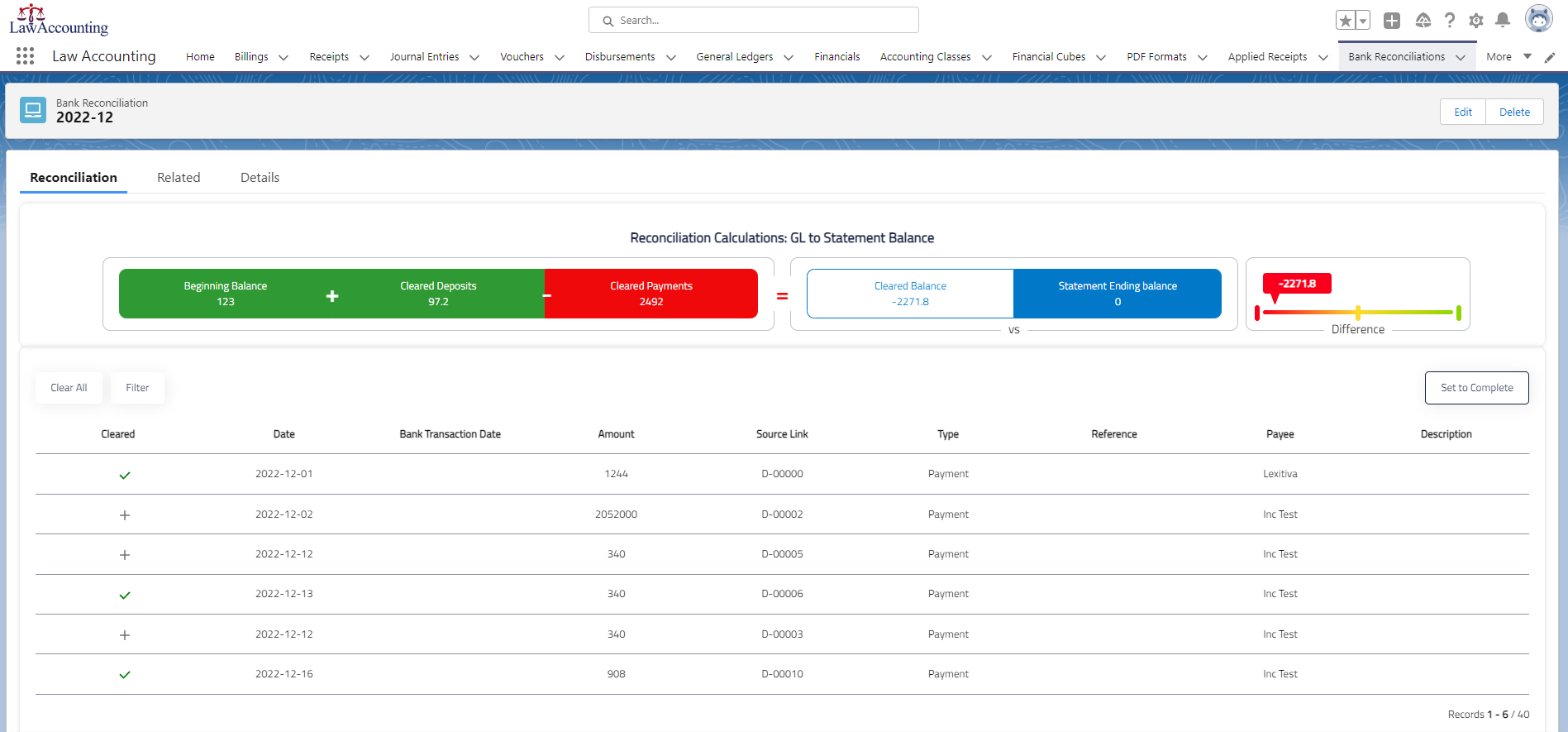

Banking

Connect directly with your bank so you can make deposits, view your account info, and make reconciliations.

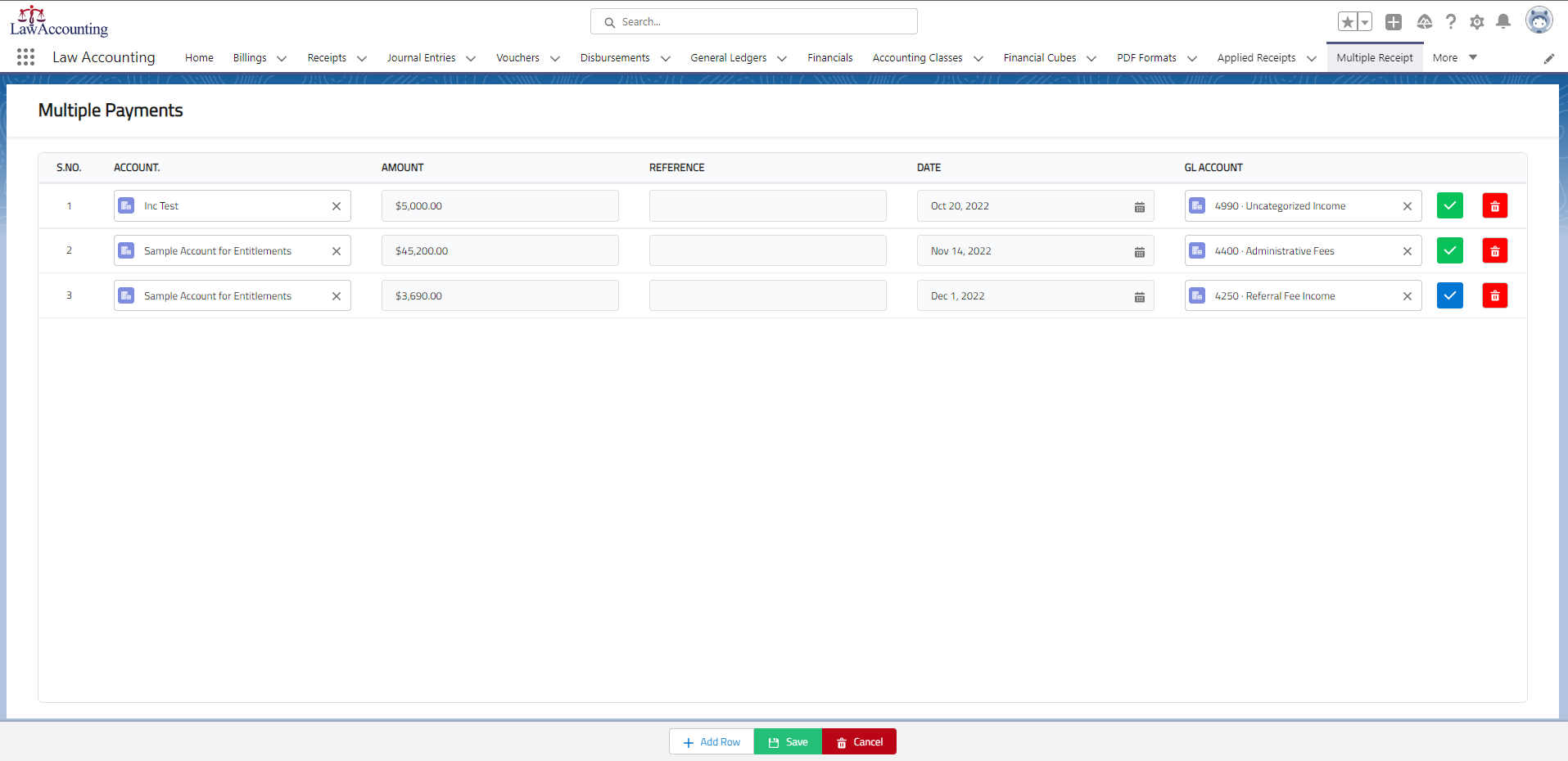

Customer Payment

Make an Entry

LawAccounting makes it easier to manage customer payments by automating many of the tasks associated with tracking and recording payments from clients. LawAccounting can generate reports that help you track customer payments and identify trends, such as, which clients are paying their bills on time and which ones are consistently late. LawAccounting allows you to record payments against multiple cases at once, also, payments can be applied at the billing line levels to control the partial payments. By automating these tasks, LawAccounting can help your law firm save time and improve the accuracy of your cash receipt processes.

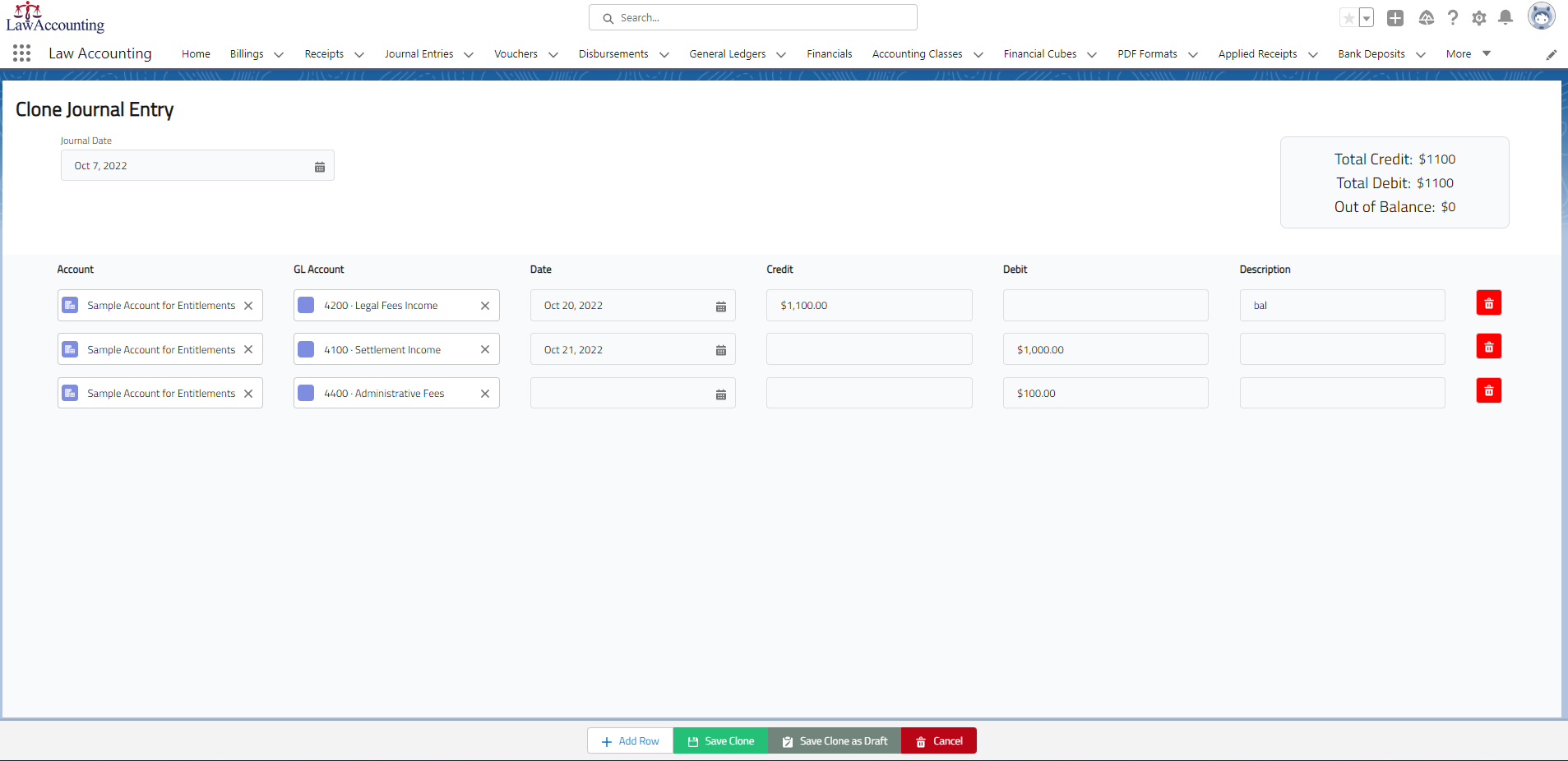

Journal Entries

Make Notes

In LawAccounting, journal entries are used to record financial transactions. A journal entry consists of a debited account and a credited account, along with the corresponding amounts. Journal entries are an important part of the legal accounting process, as they help to accurately track and record financial transactions. They can also be used to adjust accounts, such as when correcting errors or making year-end adjustments. Users can also clone the journal entries with LawAccounting.

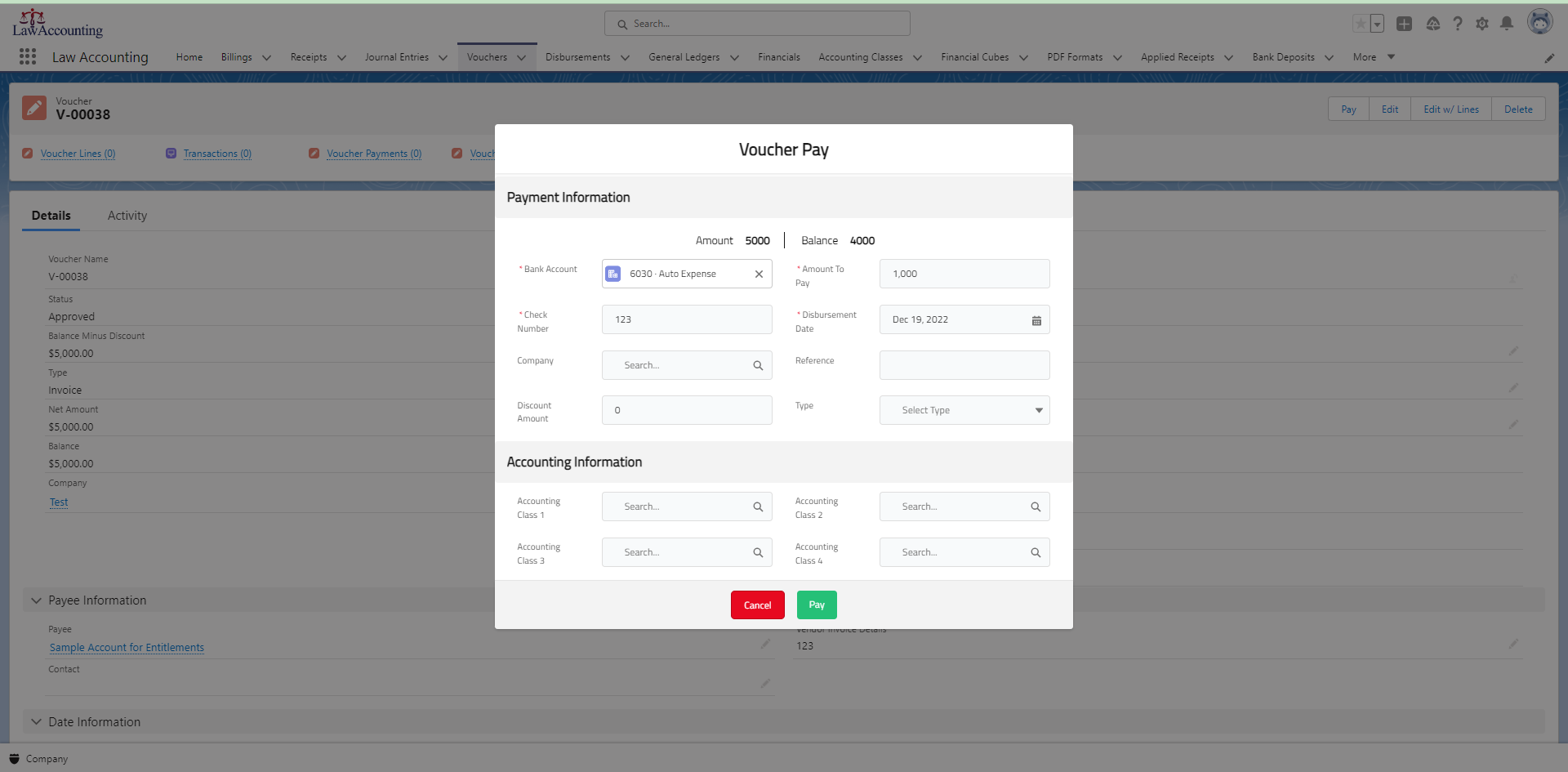

Vouchers

Make Payments

LawAccounting makes it easier to create and track vouchers by automating many of the tasks associated with managing accounts payable. LawAccounting can generate reports that help you track vouchers and identify trends, such as, which vendors and suppliers are being paid on time and which ones are consistently late. By automating these tasks, LawAccounting can help your law firm save time and improve the accuracy of your accounts payable processes.

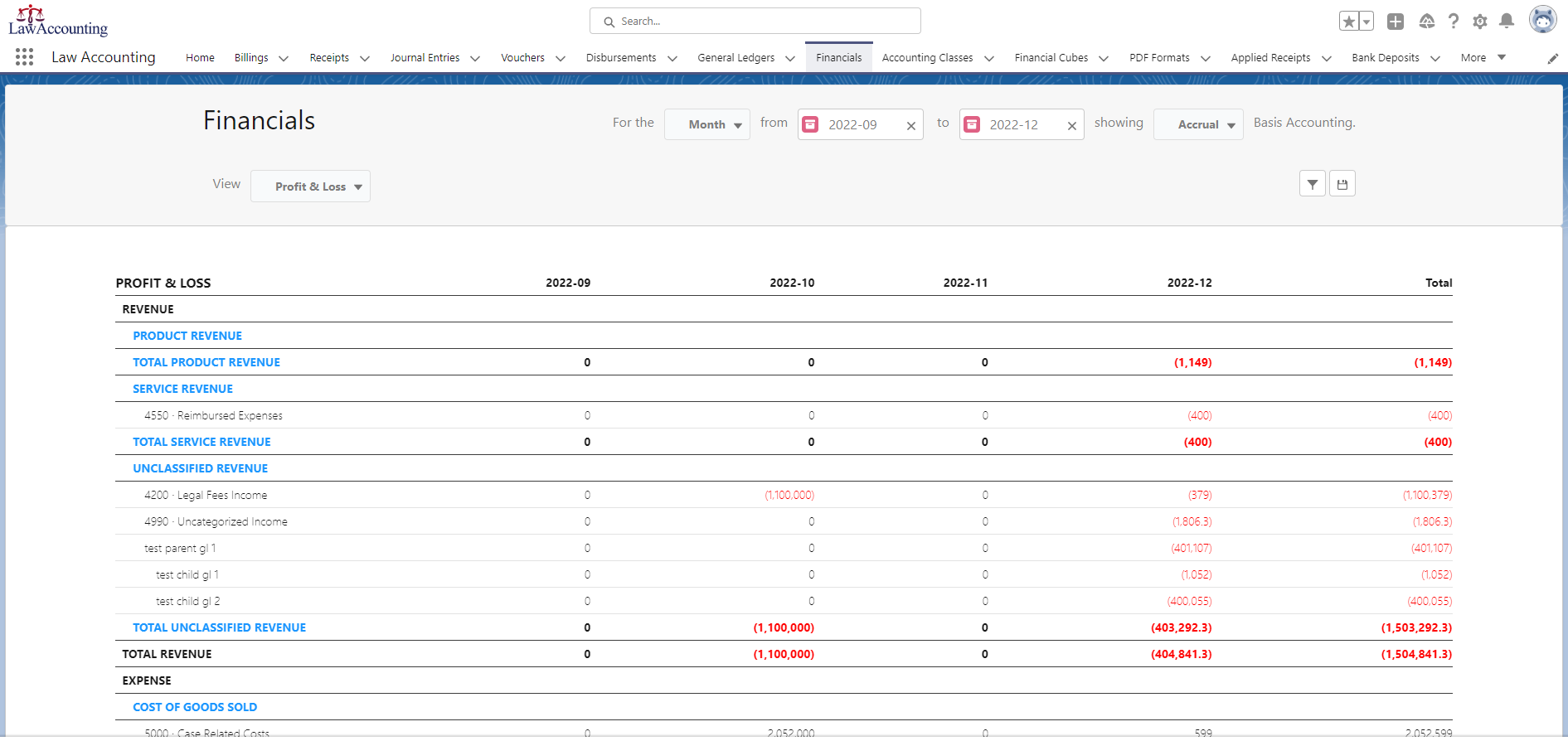

Financials

Keep Track of Everything

LawAccounting is a useful tool for generating financial reports, as it automates many of the tasks associated with data collection and analysis. Some of the financial reports that can be generated using LawAccounting include:

Income statement:Also known as a profit and loss statement, this report shows a company’s revenue, expenses, and net income over a specific period of time.

Balance sheet: This report shows a company’s financial position at a specific point in time, including its assets, liabilities, and equity.

Cash flow statement: This report shows the flow of cash into and out of a company over a specific period of time, including cash from operating, investing, and financing activities.

Budget vs. Actual: This report compares a company’s actual financial performance to its budgeted performance, showing any variances between the two.

LawAccounting can generate these reports in various formats, such as PDF, and Excel, and can be customized to meet the specific needs of your law firm.

Income statement:Also known as a profit and loss statement, this report shows a company’s revenue, expenses, and net income over a specific period of time.

Balance sheet: This report shows a company’s financial position at a specific point in time, including its assets, liabilities, and equity.

Cash flow statement: This report shows the flow of cash into and out of a company over a specific period of time, including cash from operating, investing, and financing activities.

Budget vs. Actual: This report compares a company’s actual financial performance to its budgeted performance, showing any variances between the two.

LawAccounting can generate these reports in various formats, such as PDF, and Excel, and can be customized to meet the specific needs of your law firm.

Banking

Do It All In App

Bank Connect is a feature that allows LawAccounting to connect directly to a company’s bank account, enabling users to view and manage their bank transactions within the software. Bank direct connect is a useful feature for law firms that want to streamline their financial management processes and improve the accuracy of their financial records.

Dashboard

Home Screen

LawAccounting dashboards can display a variety of metrics that are specific to the legal industry, such as Billable hours, Billing aging by the customer, Billing by customers and period, Timekeeper utilization, Profitability per lawyer, year-to-date financial data comparison by Attorney, matter, and many more. These metrics can be displayed in various formats, such as charts, graphs, and tables, and can be customized to meet the specific needs of your organization.

Billing

Create & Send

LawAccounting can make billing easier by automating many of the tasks associated with creating and sending invoices to clients. Some of the features that can make billing easier include:

Automatic billing: Automatically generate invoices based on the recorded time and tasks, eliminating the need to manually create and send invoices.

Customizable invoices: Allow users to customize the look and feel of invoices, including the layout, font, and branding.

Multiple billing methods: Supports different billing methods, such as hourly billing, fixed fee billing, and contingency fee billing.

By automating these tasks, LawAccounting can help law firms save time and improve the accuracy of their billing processes.

Automatic billing: Automatically generate invoices based on the recorded time and tasks, eliminating the need to manually create and send invoices.

Customizable invoices: Allow users to customize the look and feel of invoices, including the layout, font, and branding.

Multiple billing methods: Supports different billing methods, such as hourly billing, fixed fee billing, and contingency fee billing.

By automating these tasks, LawAccounting can help law firms save time and improve the accuracy of their billing processes.