Why Trust Reconciliation is Important for the Law Firms

Trust reconciliation is important for law firms because it helps ensure the accuracy and integrity of the financial records of the firm’s trust accounts. Trust accounts are used by law firms to hold client funds, such as retainer fees or settlement funds, in trust until they are disbursed to the appropriate parties.

Accurate and complete trust accounting is important for a number of reasons:

- It helps ensure that client funds are properly protected and managed.

- It helps prevent misappropriation of client funds, which can result in legal and ethical problems for the law firm.

- It helps ensure that the law firm is in compliance with legal and ethical rules regarding the handling of client funds.

- It helps build trust and confidence with clients, who expect their funds to be handled responsibly.

What Is Three-Way Trust Reconciliation

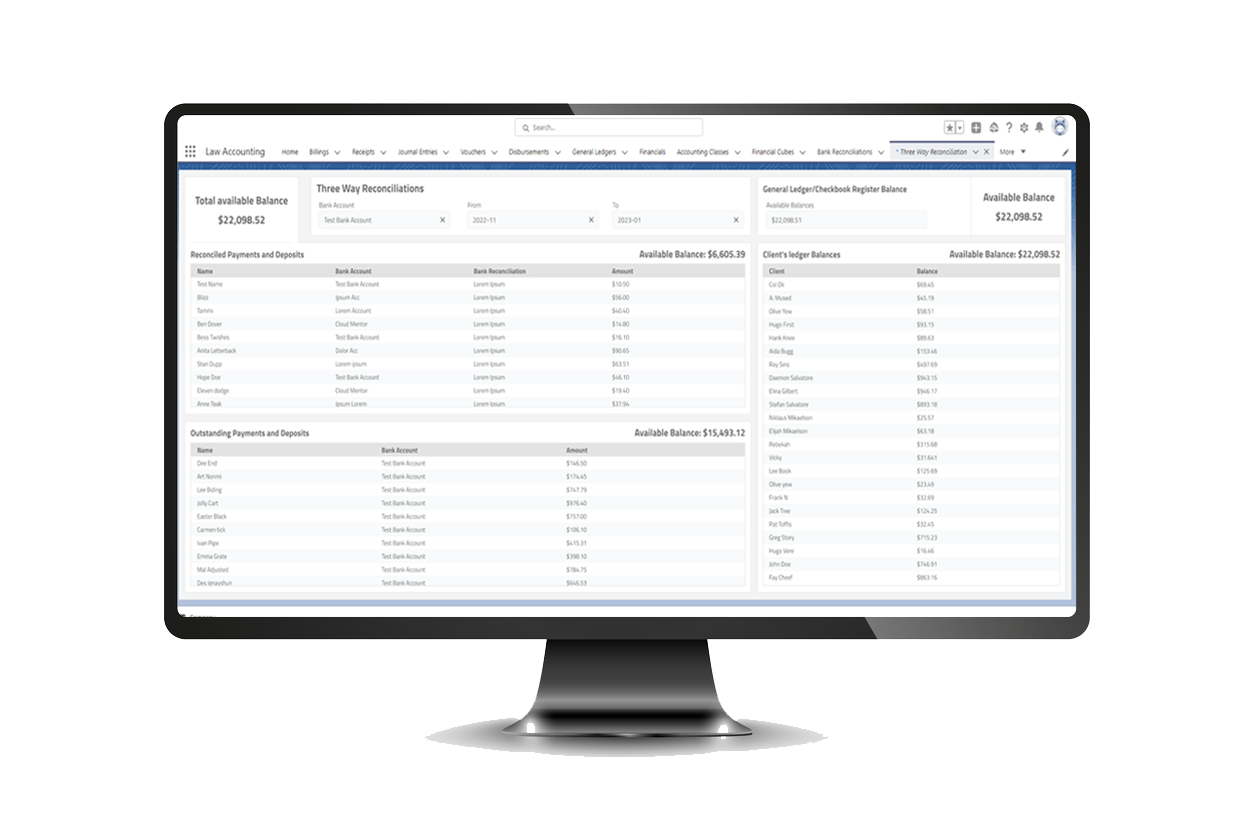

Three-way reconciliation is a process used to ensure that the financial records of a trust are accurate and complete. This process involves comparing three sets of data: the trust’s bank statement, the trust’s ledger (which records all transactions in the trust), and the trust’s checkbook (which records all checks written from the trust).

The three-way reconciliation process involves comparing these three sets of data and identifying any discrepancies or differences. For example, if a check is written from the trust but is not recorded in the trust’s ledger or checkbook, this would be identified as a discrepancy. The trust accountant would then need to investigate the discrepancy and take appropriate action to correct the error.

Three-way reconciliation is an important part of trust accounting because it helps ensure that the trust’s financial records are accurate and complete. It is typically performed on a regular basis, such as monthly or quarterly, to ensure that the trust’s financial records are up to date and accurate.

The three-way reconciliation process involves comparing these three sets of data and identifying any discrepancies or differences. For example, if a check is written from the trust but is not recorded in the trust’s ledger or checkbook, this would be identified as a discrepancy. The trust accountant would then need to investigate the discrepancy and take appropriate action to correct the error.

Three-way reconciliation is an important part of trust accounting because it helps ensure that the trust’s financial records are accurate and complete. It is typically performed on a regular basis, such as monthly or quarterly, to ensure that the trust’s financial records are up to date and accurate.

Conclusion

Trust accounting is an essential capability that must be present in any legal accounting software. This is why LawAccounting is the right choice for law firms as it automates many of the manual processes that are required for trust reconciliation, provides secure and auditable system for managing client funds, ensures compliance with legal and ethical rules, and helps to manage risk and improve efficiency. LawAccounting helps law firms streamline their accounting processes and ensure that client funds are properly accounted for and protected.

To learn more, request a demo today.

To learn more, request a demo today.